Considerations for Expats Inheriting Australian Assets – The implications for Australian expats inheriting assets from Australian family members became more complicated when the Government amended the Income Tax Assessment Act 1997 (Section 104-215) and introduced a Capital Gains Tax (CGT) event K3 in 2017.

We are seeing an increasing number of clients grappling with the consequences of the provisions as those from the Baby Boomer generation transfer wealth to their children, which include Australian expats.

In this paper we will explore the provisions in detail, consider some scenarios and some strategies to mitigate some of more onerous outcomes of the legislation.

A K3 CGT event affects assets NOT classed as ‘Taxable Australian Property’ and broadly speaking, falls into one of three categories:

- Collectables (art, jewelry, antiques)

- Personal use assets (cars, boats, furniture, electrical goods)

- Other (shares, units in unit trusts, foreign exchange, cryptocurrency)

Australian tax residents are assessed in Australia on ordinary and statutory income from all sources whether inside or outside of Australia unless a statutory rule overrides this general rule.

A foreign resident (including Australian citizens living overseas) however is generally assessable only on income from Australian sources or on income on a basis other than having an Australian source.

Australia’s double tax agreements, for countries where Australia has such an agreement, can alter these general principles.

Australian Expats Inheriting Assets Triggering a K3 CGT Event

A CGT Event K3 is triggered when an asset which falls into one of the three groups listed above, is transferred to a tax-exempt entity, such as Australian expat non-resident (a person who lives overseas), a charitable trust, or a not-for-profit society, association, or club.

‘Transferred’ means that legal ownership of that asset had passed from the estate to the beneficiary. A K3 CGT Event can be triggered without the availability of any CGT rollover relief that ordinarily applies on the death of an individual.

Further when the CGT Event K3 is triggered, the capital gain is disclosed in the final income tax return of the deceased rather than the first income tax return of the deceased estate. This makes the estate liable for the tax to be paid.

The following issues can arise from a CGT event K3:

- K3 applies to estates that include testamentary trusts. A testamentary is active once the executor has completed the administration of the estate and transferred the estate’s

assets to the trust. The ultimate transfer of assets from the testamentary trust to a beneficiary (which may be many years down the track) will attract K3. - K3 will also operate in the circumstances where the trustee of the trust is a non-tax resident and where just one of the beneficiaries or even potential beneficiaries of the trust is a non-

tax resident. As Australians are increasingly likely to live and work overseas at some point in their lives, this increases the chances that a future beneficiary could be a non-tax resident

and may trigger event K3. - Only the capital losses of the deceased individual (not the estate) can be utilized against the K3 capital gain.

- If the will has not been drafted to allocate any applicable CGT to a particular asset, other beneficiaries of the estate may be affected by the CGT attached to a gift they are not receiving (dilution of estate assets due to tax liability).

So what does CGT event K3 look like?

Scenario – Non-resident beneficiary

A parent passes away and leaves an estate of;

- $500,000 Cash

- $1,000,000 Share Portfolio ($300,000 unrealised Capital Gain at date of death)

- $1,000,000 House (her residence for the last 35 years)

She has 3 daughters, one of whom lives and works in London and has done for 8 years.

The will is a simple will distributing all the assets to the beneficiaries equally. The daughters decide to have their share of the investment portfolio transferred to their individual names.

Because one beneficiary is a non-resident it will trigger a CGT event K3 which will be disclosed and paid by the estate in the final tax return (estimated to be approximately $36,000).

The tax is effectively triggered by the one non-resident beneficiary, but the burden is shared equally via the final tax return.

In this scenario the numbers are modest and $36,000 when we are talking $2.5 Million doesn’t seem significant. However, the issue could easy be a source of resentment as when the Australian domiciled daughters sell their shares, they will also be paying CGT tax on their portfolios whilst the non-resident daughter can dispose of her shares tax free.

Strategies for Mitigation

The legislation triggers the CGT event K3 when an asset passes to a non-resident beneficiary, so in the absence of an appropriate clause in the deceased will, it might be possible for the beneficiaries to enter a deed of arrangement prior to passing assets to beneficiaries.

The Deed would facilitate for non-beneficiaries to forgo interests in CGT assets that would trigger the CGT event K3, in exchange for receiving additional other assets of the estate that will not trigger CGT event K3 when the asset passes (Cash or Taxable Property).

Prior to these arrangements the CGT and stamp duty implications need to be considered by an appropriate professional.

K3 Clause

The ideal way to minimize the impact of a K3 event is to insert a clause into the will stating that any K3 liability is to be paid from that beneficiary share of the estate.

A sample clause might be:

Notwithstanding any other provision of the Will, I direct that any tax arising by virtue of section 104-215 of the Income Tax Assessment Act 1997 in respect of any gift made under this Will is to be borne by the beneficiary receiving this gift. In this regard my Executors will:

- reduce the amount of this gift by the amount of that tax, or

- as a condition precedent to the transmission of the gift, obtain a reimbursement from the beneficiary for the amount of the tax.

Asset Selection

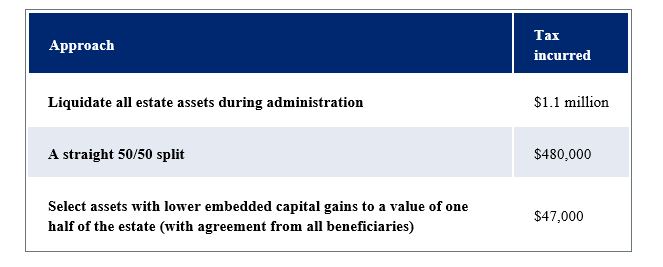

This example from Equity Trustees describes how in the case of an $11 million asset portfolio, there was a total of $4 million embedded capital gain at date of death, with two beneficiaries – one resident and one non-resident.

Depending on which of three approaches was taken, the resulting tax incurred was enormously different:

Will Drafting

A carefully crafted will can also reduce or eliminate K3 events by specifically gifting assets with higher embedded capital gains to beneficiaries that won’t trigger a K3 event.

For example, a deceased mining company employee had acquired $500,000 of shares in the company since the mid-1990s which contained a $300,000 embedded capital gain at date of death.

The shares were bequeathed to a resident family member, with the residuary (the rest of the estate) going to one resident beneficiary and one non-resident beneficiary, each receiving half as cash.

As cash is not a CGT asset, unlike shares, a K3 event did not occur in this estate.

Conclusions

The conclusions will probably depend on who is reading this article. I expect that most readers are Australian expats inheriting assets as potential beneficiaries, so it may be something you need to raise with your parents asking them to update their wills when they next have an estate planning review.

The key points are;

- K3 events affect ALL The estate pays the K3 CGT tax.

- A K3 clause should probably be included in wills.

- It is preferable to include executor discretion when drafting wills to allow for the distribution of assets in the most efficient manner to minimize K3 event taxation.

For more information and for us to appropriately direct you the best professional for your circumstances please get in contact with us here.