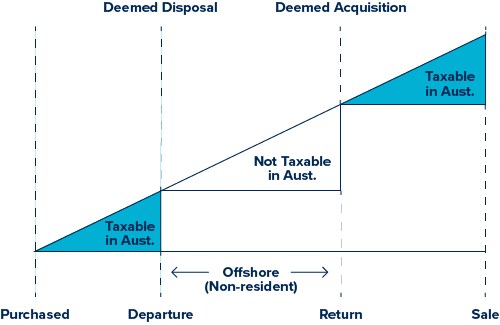

When expats cease to be an Australian tax resident, they are generally deemed to dispose of their CGT assets (other than ‘Taxable Australian Property’) at the market value.

While this gives rise to a capital gain or loss at that point, these assets are not subject to CGT for the period that you are classed as a non-resident or for the period that you are away.

On becoming an Australian resident again, they are then deemed to acquire these assets for CGT purposes at the market value of the assets as at the date you elected to become an Australian tax resident with future growth from that point subject to CGT on disposal.

The 12-month holding period to be eligible for the 50% CGT discount for individuals commences from the date they become an Australian resident again.

These deemed disposal rules are summarised in the following diagram.

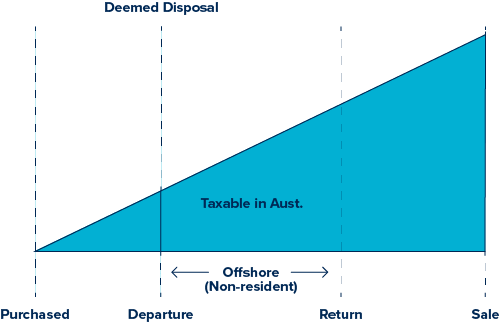

An alternative to the deemed disposal described above is for the expat to make an election to defer the CGT event that would otherwise apply on becoming a non-resident.

However, this will mean that all future gains will generally remain taxable in Australia, including the period when they are a non-resident (see diagram below).

It’s important to remember that this election to defer CGT applies to all CGT assets (except Taxable Australian Property) i.e. you can’t choose to defer the disposal for certain assets only.

The best option for clients who are about to become a non-resident for tax purposes in Australia will depend on individual circumstances, including the size of the capital gain (if any), any carry forward losses and the your cashflow position.

9 Ways We Can Help

General Advice Disclaimer

The information provided on this website has been provided as general advice only. We have not considered your financial circumstances, needs or objectives and you should seek the assistance of your Atlas Wealth Management Authorised Representative before you make any decision regarding any products mentioned in this communication. Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Atlas Wealth Management nor its related entities, employees or agents shall be liable on any ground whatsoever with respect to decisions or actions taken as a result of you acting upon such information.