Australian Expats Guide to Financial Success – It’s no secret that Australians love to explore the world and often that means packing our bags and heading overseas to start a new adventure.

Whether it’s to reunite with family, explore new cultures or chase exciting work opportunities, we all have our reasons for making the move abroad.

But let’s be real, finances also play a big role in our decision-making process. The allure of higher salaries and a lower cost of living can be hard to resist, and who can blame us?

We all want to make the most of our time overseas and ensure our financial future is secure.

At Atlas, we’ve had the privilege of helping numerous Australian expats like you navigate the complexities of international finance and we are excited to share with you some of our insights and tips that can help you build wealth.

Whether you’re a seasoned expat or just starting out on your overseas journey, we hope this article provides you with valuable information to help you make the most of your time abroad.

Living and working abroad can be a thrilling and enriching experience, but it can also provide a unique opportunity to accumulate real wealth and achieve financial success.

This is especially true when working in a tax-favoured or tax-free environment with low cost of living, which reduces expenses and increases your net income.

However, simply accumulating excess cash with minimal interest returns will not build long-term wealth. In order to maximise your financial potential, it’s important to ensure that your money is actively working for you.

Unlike an ordinary tax resident of Australia, an Australian expats investment choices must consider a variety additional influences, from taxation in both countries, individual holdings, currency fluctuations, onshore/offshore investments and geographic movements.

With so many considerations and the fear of accidently stepping onto a tax landmine, expats often end up putting their wealth goals into the ‘too hard’ basket and ultimately miss out on opportunities that are right in front of them.

How can you to build wealth as an Australian expat?

Investment Portfolios

This is probably one of the most favoured vehicles for wealth accumulation amongst expats.

Choosing to invest in a diversified investment portfolio can allow you take to advantage of its non-taxable Australian property asset treatment, effectively allowing you to build a portfolio that is capital gains tax exempt in the eyes of the ATO.

Remaining focused on a diversified strategy that bouts to your investment time horizon and risk appetite will shape your portfolio.

Currency Conversion

Ideally, your new role is paid in a currency that is favourable to the AUD, therefore making regular currency transfers home through a dollar cost averaging strategy is a quick and easy way to make a currency gain.

This will naturally mitigate the long term currency risk expats face, as you will build your wealth at home and in AUD.

Investment Property

Purchasing a property has always been the Australian dream, but it can also be a fantastic investment to build your net worth.

In most cases your take home income would be higher as an expat, meaning that you would have greater cashflow.

Banks love this, and in most cases would happily provide you a loan to fund an investment property purchase.

Whilst property is treated as taxable Australian real property, it can still be very beneficial to expats who have the right structure, ownership and tax deductions in place.

This may also act as a foothold for your eventual repatriation.

Tax Planning

Expats generally have tax responsibilities in at least two countries, therefore navigating the world of tax can become a daunting and burdensome experience.

While this is true, it can also become beneficial to your financial position. Ensuring you make the right deductions on any Australian income or have the right arrangements in place to hold or transition your wealth home, such as a family trust or company structure.

Tax planning will assist you in the protection and efficiency of your wealth as an overarching tool.

Superannuation and Retirement Planning

Whilst superannuation is agnostic with your tax residency status, it can still be used as a great tool for wealth accumulation.

Superannuation is inherently a tax favoured environment and can be an effective vehicle to place funds for long term retirement planning.

There are two contribution types that you need to keep in mind when boosting your super balance, these are non-concession and concessional.

Australian Expat Case Study

These are just a few areas where an expat can start building their wealth and everyone will have their own situational differences that will dedicate the right strategy.

Let’s look at a case study of an Australian expat investing in a share portfolio as a resident vs non-resident.

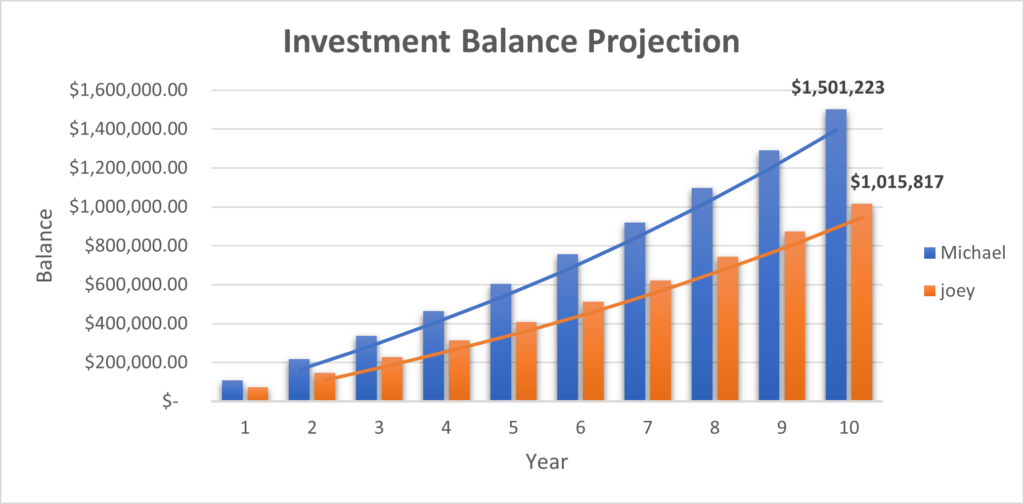

Michael is an Australian non-tax resident living in Dubai vs Joey who is ordinary tax resident living in Australia.

Both Michael and Joey are on a salary of AUD$200,000 and spend 50% of their income on expenses. The remaining funds are used to invest in a share portfolio.

Working in a tax favoured environment, Michael’s income is not taxed and therefore has a cash surplus of $100,000 annually after his expenses.

Joey on the other hand must pay income tax ($60,667) on his salary, leaving him with a balance of $139,333. After expenses Joey has a cash surplus of $67,666.

Michael and Joey each invest their surplus cash into a portfolio with a return rate of 8.50% annually for a period of 10 years, continuously whilst making their regular annual contributions.

Let’s look at the tax impact of a portfolio sell down in year 10.

| Client | Final Balance | Less Contributions | Profit Before Tax |

| Michael | $1,501,223 | $900,000 | $601,223 |

| Joey | $1,015,817 | $608,994 | $406,823 |

- Michael has been able to increase his balance due having no income tax and therefore making additional contributions, despite having the same salary and lifestyle expenses as Joey.

- At year 10, Michael returned to Australia and opted into Deemed Acquisition and correspondingly sold his entire portfolio. The tax payable to the ATO would therefore be $0.

- Joey also elected to sell his portfolio at year 10 with a profit of $406,823. Since Joey is an ordinary tax resident, this capital gain is added to his annual income and taxed at his marginal tax rate of 45%. After taxes ($183,070), Joey’s profit is $223,753.

Using the above example, the difference between investing as a non-resident (Michael) vs resident (Joey) was $377,470.

It’s worth noting that the investment comparison outlined here is just one simple example of the potential benefits that can arise from understanding and leveraging your tax residency status.

By combining various tax savings and wealth accumulation strategies, you can significantly increase your financial standing and secure a more comfortable future for yourself and your loved ones.

At Atlas, we believe that every Australian expat should have access to personalised and comprehensive financial planning services that can help them achieve their unique financial goals.

We specialise in working with expats to develop customised financial plans that take into account their individual circumstances, including their tax residency status, investment preferences and risk tolerance.

If you’re an expat looking to maximise your financial potential, we invite you to get in touch with us to schedule a consultation.

Our team of expert specialist financial planners are ready to help you navigate the complexities of international finance and take control of your financial future.

We hope this article has been thought provoking and prompted you to contemplate the ways in which your financial resources and time can be improved.